基金简单还是期货简单(基金简单还是期货简单些)

基金简单还是期货简单些,这是许多投资者在选择投资方式时的一个常见问题。基金和期货都是投资市场上常见的投资工具,但它们之间有着明显的区别。基金是一种集合投资方式,投资者将资金交给专业的基金经理进行投资,而期货则是一种衍生品,投资者通过买卖期货合约来获取利润。在选择投资方式时,投资者需要根据自己的风险承受能力、投资目标和投资知识来进行选择。

基金的简单性

基金相对于期货来说,更加简单易懂。投资者只需要选择一个符合自己投资需求的基金产品,将资金交给基金经理进行投资,无需关心具体的投资操作和交易细节。基金经理会根据基金的投资策略和目标进行投资,投资者只需要等待基金的收益。基金的投资范围广泛,可以投资股票、债券、黄金等各种资产,为投资者提供了多样化的投资选择。

期货的简单性

相比之下,期货的交易相对复杂一些。投资者需要了解期货市场的运作规则、交易机制和风险管理方法,才能够进行期货交易。期货市场的波动性较大,投资者需要具备一定的市场分析和预测能力,才能够获取稳定的投资收益。期货市场的交易时间较长,投资者需要花费更多的时间和精力来进行交易。

基金的风险

尽管基金相对于期货来说更加简单,但是基金也存在一定的风险。基金的收益受到市场波动和基金经理的投资技巧影响,投资者可能会面临投资损失的风险。基金的管理费和手续费也会对投资者的收益产生一定的影响。投资者在选择基金时需要注意基金的风险水平和收益预期,以便更好地控制投资风险。

期货的风险

相比之下,期货市场的波动性更大,投资者面临的风险也更高。期货市场的杠杆效应较大,投资者可能会面临较大的资金损失。期货市场的交易时间较长,投资者需要花费更多的时间和精力来进行交易,也增加了投资风险。投资者在选择期货时需要谨慎考虑自身的风险承受能力和投资知识,以便更好地控制投资风险。

基金相对于期货来说更加简单,适合那些对投资了解较少或者没有时间进行投资研究的投资者。而期货市场则更适合那些有一定投资经验和市场分析能力的投资者。投资者在选择投资方式时需要根据自己的情况进行权衡,选择适合自己的投资方式,以获取稳定的投资收益。Investment in funds or futures? This is a common question for many investors when choosing an investment method. Funds and futures are common investment tools in the investment market, but they have obvious differences. Funds are a collective investment method, where investors entrust funds to professional fund managers for investment, while futures are derivatives, where investors profit by trading futures contracts. When choosing an investment method, investors need to make their choice based on their risk tolerance, investment goals, and investment knowledge.

The Simplicity of Funds

Compared to futures, funds are more straightforward and easier to understand. Investors only need to choose a fund product that meets their investment needs, entrust funds to fund managers for investment, and do not need to worry about specific investment operations and trading details. Fund managers will invest according to the fund's investment strategy and objectives, and investors only need to wait for the fund's returns. Funds have a wide range of investment options, including stocks, bonds, gold, and other assets, providing investors with diversified investment choices.

The Simplicity of Futures

In contrast, futures trading is relatively more complex. Investors need to understand the rules of the futures market, trading mechanisms, and risk management methods to engage in futures trading. The futures market is highly volatile, and investors need to have market analysis and forecasting capabilities to achieve stable investment returns. In addition, the trading hours of the futures market are longer, requiring investors to spend more time and effort on trading.

Risks of Funds

Although funds are relatively simpler than futures, they also have certain risks. Fund returns are affected by market fluctuations and the investment skills of fund managers, and investors may face the risk of investment losses. In addition, fund management fees and transaction fees also affect investor returns. When choosing funds, investors need to pay attention to the risk level and expected returns of the funds to better control investment risks.

Risks of Futures

In comparison, the futures market is more volatile, and investors face higher risks. The futures market has a significant leverage effect, and investors may face significant capital losses. In addition, the longer trading hours of the futures market require investors to spend more time and effort on trading, increasing investment risks. Investors need to carefully consider their risk tolerance and investment knowledge when choosing futures to better control investment risks.

In conclusion, funds are simpler than futures and are suitable for investors who have less knowledge of investment or have no time to conduct investment research. The futures market is more suitable for investors with some investment experience and market analysis capabilities. Investors need to weigh their options based on their circumstances when choosing an investment method to obtain stable investment returns.

相关推荐

中证500指数最近半年(中证500指数最近半年涨幅)

中证500指数是中国A股市场的重要组成部分,代表着沪深两市中市值规模相对较小、但具备成长潜力的500家上市公司。 观察中证50 ...

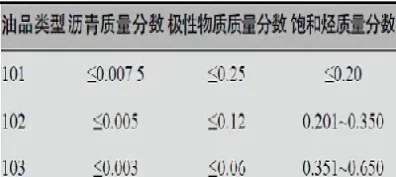

橡胶和原油的相关性有多大(橡胶和原油有关联吗)

橡胶,作为一种重要的工业原料,广泛应用于轮胎、汽车零部件、医疗器械等领域。原油,作为“工业的血液”,是现代工业的基础能 ...

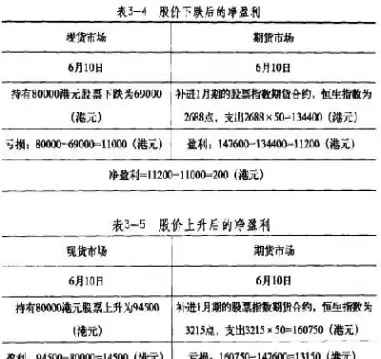

期权交易的风险和收益(期权交易最大的风险是什么投资金)

期权交易是一种复杂的金融工具,它赋予买方在特定时间以特定价格买入或卖出标的资产的权利,而非义务。这种灵活性使得期权交 ...

沪铜期货行情分析今日最新(沪铜期货行情分析今日最新价格)

沪铜期货作为国内重要的金属期货品种,其价格波动受到全球经济形势、供需关系、政策调控等多重因素的影响。每日的行情分析对 ...

国内期货主力合约午盘收盘(期货交易主力合约)

午盘收盘是国内期货市场一个重要的交易时间节点,它反映了上午半天交易时间内市场多空力量的博弈结果,为下午的交易提供了重 ...