期货连续连的是什么意思(期货连续主连指数是什么意思)

Title: Understanding the Concept of Continuous Futures and Main Contract Index in Futures Trading

Introduction:

In the world of futures trading, the term "continuous futures" and "main contract index" are commonly used phrases that hold significant importance. This article aims to provide a comprehensive understanding of these concepts and their implications in the futures market. We will explore the meaning of continuous futures, delve into the significance of main contract indexes, and highlight their role in futures trading.

H2: What are Continuous Futures?

Continuous futures, also known as "futures contracts," represent an agreement between two parties to trade an asset at a predetermined price and specified date in the future. Unlike traditional stocks or bonds, futures contracts allow traders to speculate on the price movement of commodities, such as crude oil, gold, agricultural products, or financial instruments like stock market indices.

Continuous futures, in essence, refer to the ongoing chain of contracts that traders roll over from one expiration month to the next as each contract reaches its maturity date. This continuous rollover allows traders to extend their positions beyond a single contract's expiration.

H2: Significance of Continuous Futures:

1. Smooth Transition: One of the key benefits of continuous futures is the ability to maintain continuity and avoid disruption when transitioning from one contract to another. A seamless transition ensures that traders can hold their positions without any gaps or loss of exposure.

2. Liquidity and Market Depth: Continuous futures contribute to the overall liquidity and market depth in the futures market. By connecting multiple contract months, the continuous futures market combines the trading volume of various contract months, resulting in greater liquidity. This increased liquidity allows for more stable prices and better execution of trades.

3. Risk Management: Continuous futures enable traders to manage their risks effectively by providing a continuous trading platform. Traders can adjust their positions, hedge against price fluctuations, or enter and exit the market as and when required. This flexibility enhances risk management strategies and assists in minimizing potential losses.

H2: Main Contract Index in Futures Trading:

The concept of the main contract index is closely related to continuous futures. It refers to the index derived from the prices of the main trading contract of a particular futures market.

In futures trading, multiple contracts exist for a given asset, each having different expiration dates. The main contract index represents the most actively traded or the most representative contract. It is typically the contract with the highest trading volume, as it attracts the majority of market participants. The main contract index serves as a benchmark for the overall performance of the futures market.

The main contract index provides valuable information to traders and investors. It helps them gauge market sentiment, track price trends, and make informed trading decisions. Traders often refer to the main contract index to identify potential trading opportunities, as it reflects the collective behavior and expectations of market participants.

Conclusion:

Continuous futures and main contract indexes are fundamental concepts in futures trading. Understanding the mechanics of continuous futures and the significance of main contract indexes is essential for traders to navigate the futures market successfully. Continuous futures allow for uninterrupted trading and provide liquidity, while main contract indexes serve as benchmarks for market performance. By comprehending these concepts, traders can make informed decisions and effectively manage risks in the dynamic world of futures trading.

相关推荐

期货商品的溢价率(期货商品的溢价率怎么算)

期货市场是一个充满机遇与挑战的场所,投资者通过买卖期货合约来对冲风险或进行投机。而理解期货合约的价格,特别是期货合约 ...

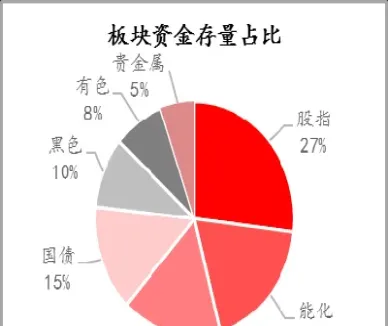

期货市场规模持续扩大(期货市场交易规模稳步扩大)

导语: 近年来,我国期货市场交易规模稳步扩大,市场深度和广度持续提升,对实体经济的服务功能日益增强。这不仅反映了我国金 ...

红枣期货后市向上的概率较大(红枣期货还能涨吗)

近期红枣期货价格波动较大,市场上关于其后市走势的观点也分歧显著。将从多个角度分析,论证红枣期货后市向上概率较大的观点 ...

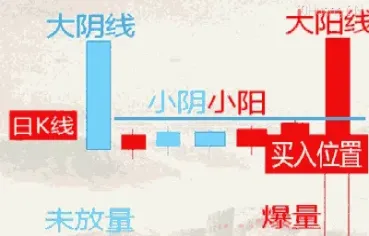

期货大阳线怎么算(期货大阴线是什么意思)

期货交易中,大阳线和大阴线是价格波动剧烈的表现形式,它们直观地反映了市场多空力量的对比以及市场情绪的转变。准确理解大 ...

期货十字阴线图解(期货十字线形态图解)

十字星,在期货交易中是一个较为常见的K线形态,它常常被交易者用来判断行情的转折点或持续性。但十字星并非单独存在,它常 ...