红枣期货的风险预测(红枣2021期货分析报告)

关于红枣期货的风险预测的知识,小编特意去互联网上搜索了相关的知识,现在整理出来供大家查阅使用。

红枣期货的风险预测

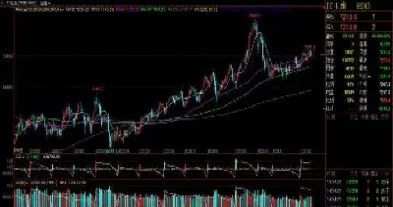

随着社会的发展和人们对健康的重视,红枣作为一种营养丰富、具有保健功效的食品,受到了广泛的关注。红枣期货作为金融衍生品的一种,通过对红枣的未来价格进行预测和交易,为生产者、加工商和投资者提供了一个有效的风险管理工具。红枣期货市场同样面临着一些风险,投资者在进行交易时需要注意。

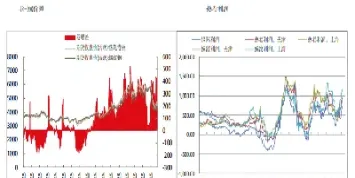

红枣期货市场的供需因素是影响价格波动的主要因素之一。红枣作为一种农产品,其价格受到季节性、气候变化、产量波动等因素的影响。例如,如果某一年红枣的产量较低,市场供应不足,价格可能会上涨。而如果红枣的产量高于市场需求,价格可能会下跌。投资者在进行红枣期货交易时,需要关注相关的供需信息,以便及时调整交易策略。

市场情绪和投机行为也会对红枣期货价格产生影响。投资者的情绪和行为往往会导致市场价格的波动,尤其是在短期内。例如,当市场对红枣需求增加的预期较高时,投资者可能会出现追涨杀跌的情况,导致价格过度波动。投资者在进行红枣期货交易时,需要保持冷静的头脑,避免盲目跟风,制定合理的交易策略。

外部经济和政策因素也会对红枣期货市场产生影响。红枣的价格往往与经济发展、汇率变动等因素密切相关。例如,如果国内经济增长放缓,消费者购买力下降,红枣需求可能会受到影响,进而影响市场价格。同时,政府相关政策的变动也可能对红枣期货市场产生影响。投资者在进行红枣期货交易时,需要密切关注国内外经济和政策的动态,及时调整交易策略。

投资者自身的风险承受能力也是需要考虑的因素之一。红枣期货市场存在着一定的风险,投资者需要根据自身的投资经验、资金状况和风险承受能力来选择适合自己的交易策略。同时,投资者还需要注意风险管理的重要性,合理控制仓位,设置止损点,避免因过度风险而造成巨额损失。

红枣期货作为一种金融衍生品,为投资者提供了一个有效的风险管理工具。投资者在进行红枣期货交易时仍然需要注意市场供需、市场情绪、外部经济和政策因素以及自身风险承受能力等因素,以便制定合理的交易策略,降低风险,并获得更好的投资回报。

参考译文:

Risk Prediction for Red Date Futures

With the development of society and people\'s increasing focus on health, red dates, as a nutritious and health-promoting food, have gained widespread attention. Red date futures, as a type of financial derivative, provide an effective risk management tool for producers, processors, and investors by predicting and trading future prices of red dates. However, the red date futures market also faces certain risks that investors need to be aware of when engaging in trading.

Firstly, supply and demand factors are one of the main drivers of price fluctuations in the red date futures market. As an agricultural product, the price of red dates is influenced by seasonal variations, climate changes, and yield fluctuations. For example, if the production of red dates is low in a particular year, resulting in insufficient market supply, prices may rise. Conversely, if the production of red dates exceeds market demand, prices may fall. Therefore, investors need to pay attention to relevant supply and demand information in order to adjust their trading strategies in a timely manner.

Secondly, market sentiment and speculative behavior can also impact red date futures prices. Investor sentiment and behavior often lead to market price volatility, especially in the short term. For example, when there is a high expectation of increased demand for red dates in the market, investors may engage in chasing highs and selling lows, resulting in excessive price fluctuations. As a result, investors need to maintain a calm mindset when engaging in red date futures trading, avoid blindly following the crowd, and develop sound trading strategies.

Additionally, external economic and policy factors can also influence the red date futures market. The price of red dates is often closely related to economic development, exchange rate fluctuations, and other factors. For example, if domestic economic growth slows down and consumer purchasing power decreases, red date demand may be affected, thereby impacting market prices. At the same time, changes in government policies may also have an impact on the red date futures market. Therefore, investors need to closely monitor domestic and international economic and policy dynamics when engaging in red date futures trading and adjust their trading strategies accordingly.

Finally, investors\' own risk tolerance is also a factor to consider. The red date futures market carries certain risks, and investors need to choose trading strategies that are suitable for their own investment experience, financial condition, and risk tolerance. At the same time, investors need to pay attention to the importance of risk management, such as controlling positions appropriately, setting stop-loss points, and avoiding substantial losses due to excessive risk.

In conclusion, red date futures provide an effective risk management tool for investors. However, investors still need to pay attention to factors such as supply and demand, market sentiment, external economic and policy factors, and their own risk tolerance when engaging in red date futures trading in order to develop sound trading strategies, reduce risks, and achieve better investment returns.

相关推荐

富时a50期指连续(富时a50期指连续开盘时间)

富时A50期指连续合约是追踪在新加坡交易所 (SGX) 上市的富时中国A50指数期货的连续合约。 它以其流动性高、交易量大、交易时 ...

热卷期货收盘时间(热卷期货价格受什么影响)

热卷期货是一种重要的金融衍生品,它允许投资者对未来热轧卷板的价格进行交易。热卷期货的收盘时间至关重要,因为它标志着当 ...

沪铜期货中午什么时候交易(沪铜期货交割时间)

沪铜期货是中国上海期货交易所(SHFE)上市的一种重要的有色金属期货合约,交易活跃,对全球铜价具有重要影响。了解沪铜期货 ...

粮食期货六日开盘吗(期货六日开盘吗)

粮食期货是期货市场的重要组成部分,对于农产品生产者、加工商和消费者都具有重要的影响。理解粮食期货的交易时间,特别是它 ...

怎样交易国际股指期货(国际股指期货行情)

国际股指期货是追踪特定国家或地区股票市场指数的期货合约。它允许投资者对全球股市的整体表现进行投机或对冲风险。了解如何 ...